Buying or selling a residential property is one of the biggest financial decisions most people will make. Whether you’re purchasing your first home, upgrading, or selling an investment property, having a trusted Auckland property lawyer by your side can make the process smoother, faster, and less stressful. At McVeagh Fleming, our team of residential property lawyers guide clients through every step of the buying and selling journey.

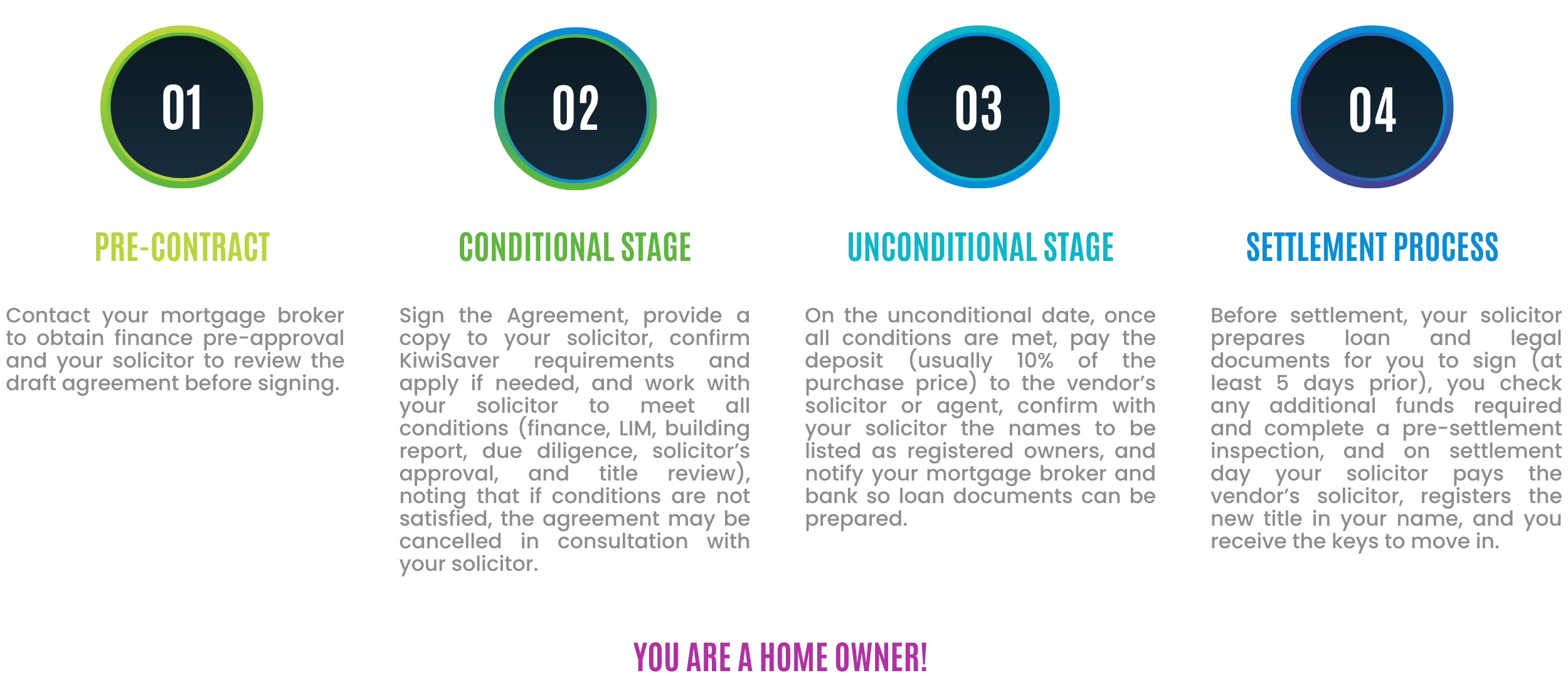

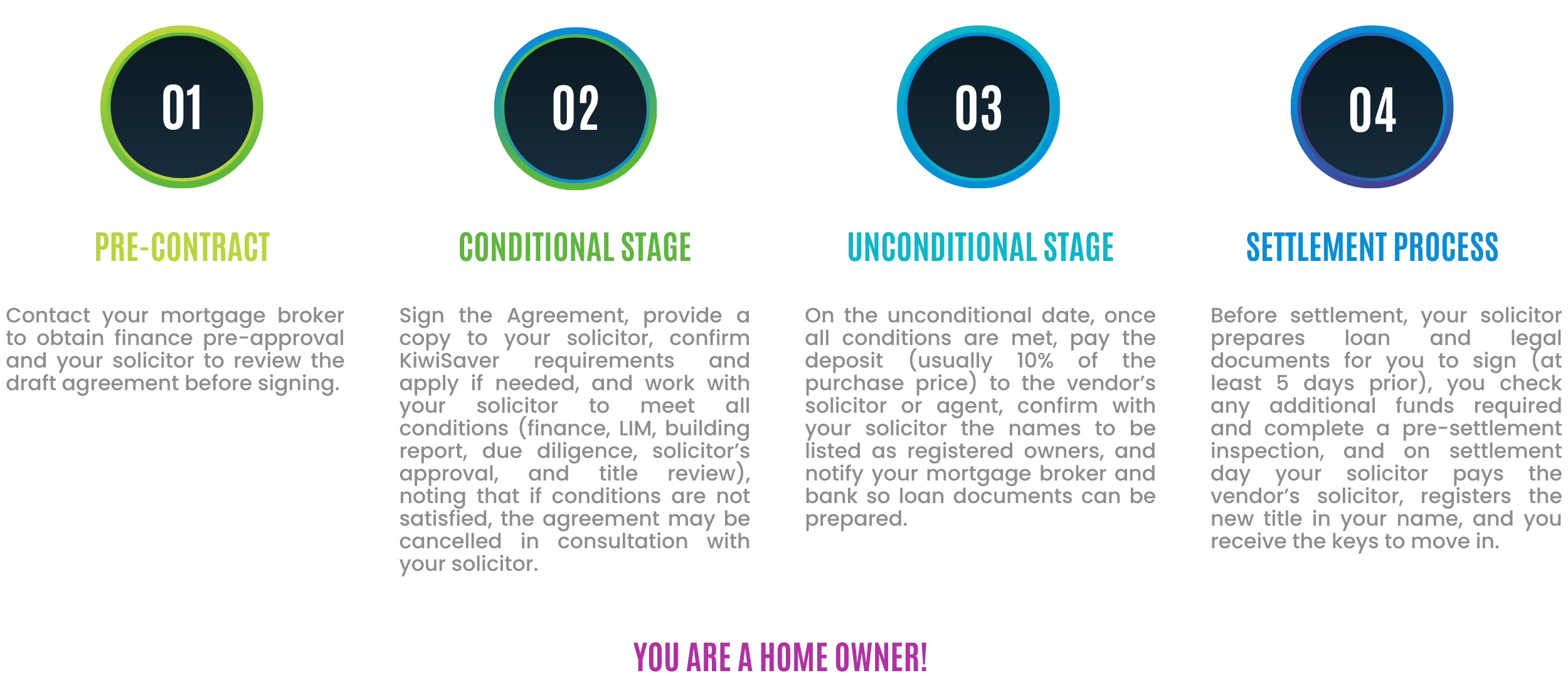

The process of purchasing a house in Auckland can be complex. From making an offer, understanding the Sale and Purchase Agreement, to completing due diligence and final settlement, each step requires careful legal review. Our residential property lawyers ensure that every document is clear and protects your interests. Below is a standard property purchase process:

When selling, timing, contracts, and compliance are key. Having the right lawyer ensures your Sale and Purchase Agreement is watertight, that disclosure obligations are met, and that settlement runs smoothly. McVeagh Fleming can help you avoid common pitfalls and achieve a hassle-free sale. Some key things to consider are:

Most people do not simply have enough cash lying around to satisfy the purchase price of a property fully and will need a bank loan to finance their agreement. As a rule of thumb, a bank will ordinarily require a 10% deposit, but this may be subject to a number of criteria, for example the location of the property, the value of the property, and how much you can repay each month. Bear in mind that your bank may impose a number of further conditions before they are willing to finance your purchase, for example they will most likely want a valuer's report for the property, which will need to be obtained at your cost. Provided you have met all their conditions, a bank will often "pre-approve" a certain amount prior to you making an offer on a property or bidding at an auction.

The information contained in these resources could potentially impact your future enjoyment of the property, and is a "must" before you consider purchasing a property. Looking through the Council files will give you an idea of rates for the property, works carried out on the property, and restrictions on land and building if you have future projects in mind. A Title search will let you know if there are any encumbrances on the Title, which might prevent a smooth settlement and could require the attention of the vendor before the purchase is unconditional.

Checking for dampness in the era of "leaky homes" has become part and parcel of the sale and purchase process. This is especially the case for homes built from the early to mid-1990's - 2004. Even if a property does not show outward signs of being leaky, there may still be hidden problems that arise later on, having a huge effect on your health and your wallet.

Purchasing or selling your home may be an ideal time to consider how you structure the ownership of your assets. If you are self-employed or wish to protect your assets in the most robust way possible, purchasing your new home through a family trust could be the best approach.

Having an experienced solicitor guide you through a sale and purchase is invaluable. Your solicitor can assist you in all aspects of the transaction and will know the common pitfalls/issues to be aware of before you enter into an agreement. Even if you do not have a solicitor acting at the time of entering the agreement, you will need to engage one straight after. Property law in New Zealand has many technical requirements - a mistake could lead to delays, penalties, or even failed sales. Our conveyancing lawyers in Auckland provide peace of mind, ensuring your rights are protected from start to finish.

Our residential property team regularly assists with:

With decades of experience in Auckland’s property market, McVeagh Fleming is trusted by individuals, families, and investors. We combine legal expertise with a practical, client-focused approach. Our goal is to help you move into your new home or complete your sale with confidence.

If you are buying or selling a house in Auckland, don’t leave it to chance. Contact McVeagh Fleming’s residential property team today to ensure your property transaction is seamless and stress-free.

Buying or selling a residential property is one of the biggest financial decisions most people will make. Whether you’re purchasing your first home, upgrading, or selling an investment property, having a trusted Auckland property lawyer by your side can make the process smoother, faster, and less stressful. At McVeagh Fleming, our team of residential property lawyers guide clients through every step of the buying and selling journey.

The process of purchasing a house in Auckland can be complex. From making an offer, understanding the Sale and Purchase Agreement, to completing due diligence and final settlement, each step requires careful legal review. Our residential property lawyers ensure that every document is clear and protects your interests. Below is a standard property purchase process:

When selling, timing, contracts, and compliance are key. Having the right lawyer ensures your Sale and Purchase Agreement is watertight, that disclosure obligations are met, and that settlement runs smoothly. McVeagh Fleming can help you avoid common pitfalls and achieve a hassle-free sale. Some key things to consider are:

Most people do not simply have enough cash lying around to satisfy the purchase price of a property fully and will need a bank loan to finance their agreement. As a rule of thumb, a bank will ordinarily require a 10% deposit, but this may be subject to a number of criteria, for example the location of the property, the value of the property, and how much you can repay each month. Bear in mind that your bank may impose a number of further conditions before they are willing to finance your purchase, for example they will most likely want a valuer's report for the property, which will need to be obtained at your cost. Provided you have met all their conditions, a bank will often "pre-approve" a certain amount prior to you making an offer on a property or bidding at an auction.

The information contained in these resources could potentially impact your future enjoyment of the property, and is a "must" before you consider purchasing a property. Looking through the Council files will give you an idea of rates for the property, works carried out on the property, and restrictions on land and building if you have future projects in mind. A Title search will let you know if there are any encumbrances on the Title, which might prevent a smooth settlement and could require the attention of the vendor before the purchase is unconditional.

Checking for dampness in the era of "leaky homes" has become part and parcel of the sale and purchase process. This is especially the case for homes built from the early to mid-1990's - 2004. Even if a property does not show outward signs of being leaky, there may still be hidden problems that arise later on, having a huge effect on your health and your wallet.

Purchasing or selling your home may be an ideal time to consider how you structure the ownership of your assets. If you are self-employed or wish to protect your assets in the most robust way possible, purchasing your new home through a family trust could be the best approach.

Having an experienced solicitor guide you through a sale and purchase is invaluable. Your solicitor can assist you in all aspects of the transaction and will know the common pitfalls/issues to be aware of before you enter into an agreement. Even if you do not have a solicitor acting at the time of entering the agreement, you will need to engage one straight after. Property law in New Zealand has many technical requirements - a mistake could lead to delays, penalties, or even failed sales. Our conveyancing lawyers in Auckland provide peace of mind, ensuring your rights are protected from start to finish.

Our residential property team regularly assists with:

With decades of experience in Auckland’s property market, McVeagh Fleming is trusted by individuals, families, and investors. We combine legal expertise with a practical, client-focused approach. Our goal is to help you move into your new home or complete your sale with confidence.

If you are buying or selling a house in Auckland, don’t leave it to chance. Contact McVeagh Fleming’s residential property team today to ensure your property transaction is seamless and stress-free.